Our

Projects

Scully Mine.

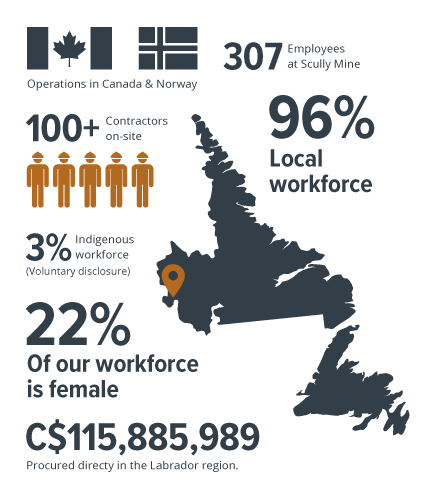

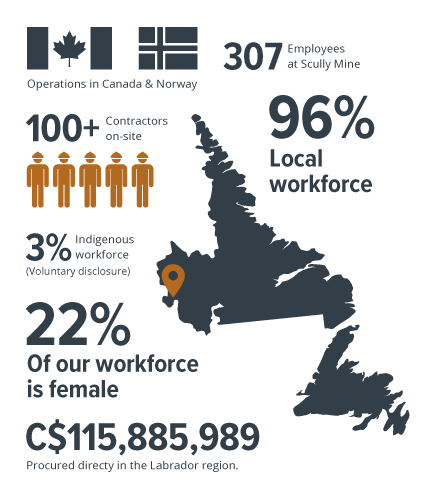

On July 18, 2017, Tacora completed the acquisition of the Scully Mine, an iron ore mine and processing facility located north of the Town of Wabush in Newfoundland and Labrador, Canada, together with the Wabush Lake Railway.

The mine started operations in 1965 and eventually closed in 2014 under the restructuring of Cliff Natural Resources. During that period of operation, the mine had produced between 2.7 million and 6 million tons of iron ore concentrate annually which was shipped to Pointe Noire to be pelletized.

Following the completion of a Feasibility Study (NI 43 – 101) for the Scully Mine in December 2017, as prepared by G Mining Services, Inc. (“GMS”) and Ausenco, Tacora focused on opportunities to finance the restart of the Scully Mine. On November 27th, 2018, Tacora announced it had closed on $212 million in private equity and senior secured debt financing, which together with up to $64 million in mining equipment debt financing, fully funded the restart of the Scully Mine. In addition, during the 2018 fiscal year, the Company amended the Cargill Offtake Agreement and finalized certain port access agreements and rail/transportation agreements in anticipation of the successful restart of the Scully Mine. During the course of the 2019 fiscal year, Tacora restarted mining operations and commercial production at the Scully Mine. On May 25th, 2019, ore was delivered to the crusher and the first mill was successfully started up on May 28th, 2019.

During June 2019, the Tacora successfully commissioned its concentrator and produced its first batch of wet concentrate, undertook its first mine blast and celebrated its first loaded train. On August 30, 2019, the Tacora announced that its first seaborne vessel shipment of iron ore concentrate produced at the Scully Mine departed the Port of Sept-Îles, Quebec, with a payload of 69,770 wmt of premium concentrate bound for a customer in Europe. Throughout the remainder of the 2019 fiscal year, Tacora continued the process of ramping up commercial production (including bringing all six mills into operation).

Scully mine produces product with a concentrate grade as set out in the initial feasibility study at 65.9% Fe, a level that exceeds the specifications of both the industry’s standard 62% benchmark as well as the industry’s high grade 65% benchmark, with respect to both grade and quality. Tacora has an agreement with Cargill, who will purchase 100% of the high-grade iron ore concentrate produced by Scully Mine through to the end of 2022.

On July 18, 2017, Tacora completed the acquisition of the Scully Mine, an iron ore mine and processing facility located north of the Town of Wabush in Newfoundland and Labrador, Canada, together with the Wabush Lake Railway.

The mine started operations in 1965 and eventually closed in 2014 under the restructuring of Cliff Natural Resources. During that period of operation, the mine had produced between 2.7 million and 6 million tons of iron ore concentrate annually which was shipped to Pointe Noire to be pelletized.

Following the completion of a Feasibility Study (NI 43 – 101) for the Scully Mine in December 2017, as prepared by G Mining Services, Inc. (“GMS”) and Ausenco, Tacora focused on opportunities to finance the restart of the Scully Mine. On November 27th, 2018, Tacora announced it had closed on $212 million in private equity and senior secured debt financing, which together with up to $64 million in mining equipment debt financing, fully funded the restart of the Scully Mine. In addition, during the 2018 fiscal year, the Company amended the Cargill Offtake Agreement and finalized certain port access agreements and rail/transportation agreements in anticipation of the successful restart of the Scully Mine. During the course of the 2019 fiscal year, Tacora restarted mining operations and commercial production at the Scully Mine. On May 25th, 2019, ore was delivered to the crusher and the first mill was successfully started up on May 28th, 2019.

During June 2019, the Tacora successfully commissioned its concentrator and produced its first batch of wet concentrate, undertook its first mine blast and celebrated its first loaded train. On August 30, 2019, the Tacora announced that its first seaborne vessel shipment of iron ore concentrate produced at the Scully Mine departed the Port of Sept-Îles, Quebec, with a payload of 69,770 wmt of premium concentrate bound for a customer in Europe. Throughout the remainder of the 2019 fiscal year, Tacora continued the process of ramping up commercial production (including bringing all six mills into operation).

Scully mine produces product with a concentrate grade as set out in the initial feasibility study at 65.9% Fe, a level that exceeds the specifications of both the industry’s standard 62% benchmark as well as the industry’s high grade 65% benchmark, with respect to both grade and quality. Tacora has an agreement with Cargill, who will purchase 100% of the high-grade iron ore concentrate produced by Scully Mine through to the end of 2022.

Sydvaranger Mine.

Sydvaranger has a long mining history, with ore deposits first discovered in 1866. The first load of iron ore was railed from the Bjørnevatn ore deposit to the town of Kirkenes in 1910. Sydvaranger operated from 1910 to 1997 with over 200 million tonnes of ore unearthed, and was the largest mine in Norway.

During WW2, the mine was operated by German forces, and due to the considerable conflict in the area and Sydvaranger’s strategic importance, there was significant damage to the mine’s infrastructure and facilities. It was subsequently rebuilt and restored with the assistance of Marshall Plan funding by the Norwegian government, but following a highly profitable period the company was unfortunately forced to close in 1997 due to persistently low iron ore prices and repercussions of cold war tensions.

The mine, rail and processing facilities were refurbished in 2008 and recommissioned in 2009 by ASX-listed Northern Iron Limited. Sydvaranger Gruve AS (SVG) operated from 2009 to 2015 with 20 million tonnes of ore mined and 8 million tonnes of magnetite concentrate (68% Fe) sold to Europe, the Middle East, and China. The mine and production facilities operated with increasing efficiency, reliability, and lower costs until November 2015 when the global iron ore market deteriorated and the mine shut its doors once more.

In April 2016, the Tschudi Group acquired the Sydvaranger assets. All equipment necessary for the restart of operations was secured and has since been carefully maintained. All necessary operating permits are also in place, with the mining permit granted in the spring of 2019. Sydvaranger has since focused its activities on supporting the successful restart of operations. This work has included an extensive analytical program to upgrade the geological database from drill core samples gathered over the past 100 years, an independent verification of the Sydvaranger resources, as well as a completion of all mine engineering designs that will underpin a sustainable and responsible operating plan for years to come.

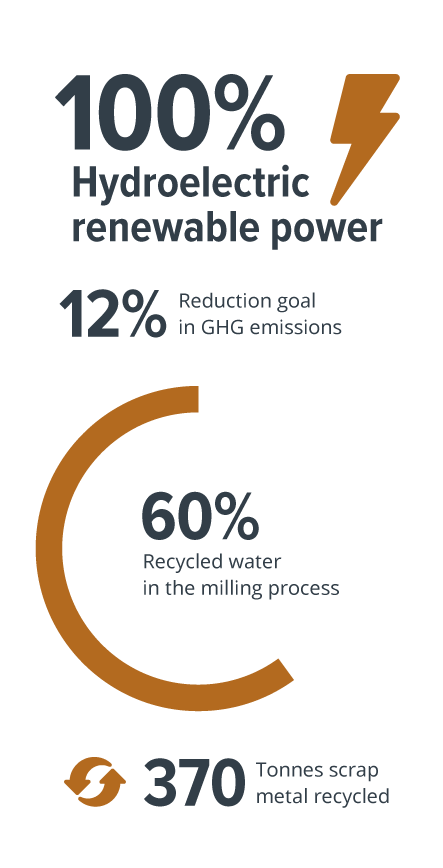

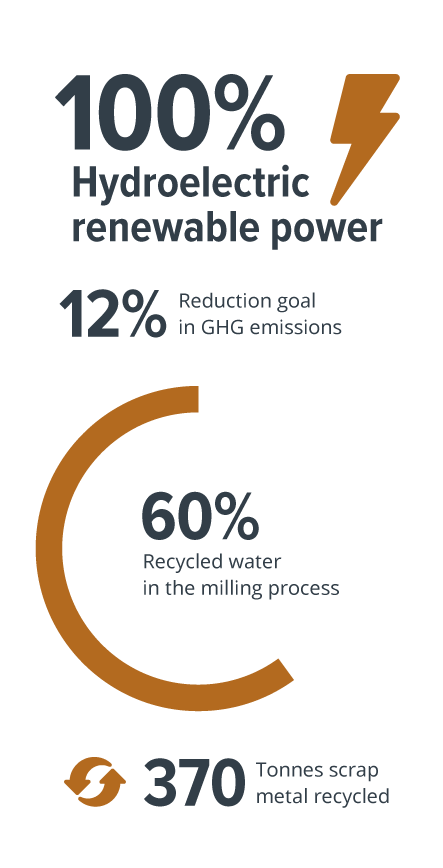

The high quality, low impurity Sydvaranger product has significant environmental and cost benefits relative to hematite feedstocks including increased furnace productivity, reduced energy requirements of pelletizing, reduced slag volumes, and lower CO2 emissions. Consequently, not only does the high-quality ore produce more steel per tonne of input, but it also has a lower climate footprint.

On January 13, 2021, Tacora Resources completed the acquisition of 100% of the share capital of Sydvaranger Mining AS (the “Sydvaranger Mine” or “Sydvaranger”). The Sydvaranger Mine is a longlife iron ore open pit, mineral processing plant, and port. The concentrator and port facilities are in the town of Kirkenes, Norway and the mines are 8 km to the south near the town of Bjørnevatn, Norway. As a result of the acquisition, Tacora has the option to restart the Sydvaranger Mine which is shovel ready and fully permitted in a tier 1 jurisdiction. Sydvaranger is currently under a care and maintenance program.

Sydvaranger has a long mining history, with ore deposits first discovered in 1866. The first load of iron ore was railed from the Bjørnevatn ore deposit to the town of Kirkenes in 1910. Sydvaranger operated from 1910 to 1997 with over 200 million tonnes of ore unearthed, and was the largest mine in Norway.

During WW2, the mine was operated by German forces, and due to the considerable conflict in the area and Sydvaranger’s strategic importance, there was significant damage to the mine’s infrastructure and facilities. It was subsequently rebuilt and restored with the assistance of Marshall Plan funding by the Norwegian government, but following a highly profitable period the company was unfortunately forced to close in 1997 due to persistently low iron ore prices and repercussions of cold war tensions.

The mine, rail and processing facilities were refurbished in 2008 and recommissioned in 2009 by ASX-listed Northern Iron Limited. Sydvaranger Gruve AS (SVG) operated from 2009 to 2015 with 20 million tonnes of ore mined and 8 million tonnes of magnetite concentrate (68% Fe) sold to Europe, the Middle East, and China. The mine and production facilities operated with increasing efficiency, reliability, and lower costs until November 2015 when the global iron ore market deteriorated and the mine shut its doors once more.

In April 2016, the Tschudi Group acquired the Sydvaranger assets. All equipment necessary for the restart of operations was secured and has since been carefully maintained. All necessary operating permits are also in place, with the mining permit granted in the spring of 2019. Sydvaranger has since focused its activities on supporting the successful restart of operations. This work has included an extensive analytical program to upgrade the geological database from drill core samples gathered over the past 100 years, an independent verification of the Sydvaranger resources, as well as a completion of all mine engineering designs that will underpin a sustainable and responsible operating plan for years to come.

The high quality, low impurity Sydvaranger product has significant environmental and cost benefits relative to hematite feedstocks including increased furnace productivity, reduced energy requirements of pelletizing, reduced slag volumes, and lower CO2 emissions. Consequently, not only does the high-quality ore produce more steel per tonne of input, but it also has a lower climate footprint.

On January 13, 2021, Tacora Resources completed the acquisition of 100% of the share capital of Sydvaranger Mining AS (the “Sydvaranger Mine” or “Sydvaranger”). The Sydvaranger Mine is a longlife iron ore open pit, mineral processing plant, and port. The concentrator and port facilities are in the town of Kirkenes, Norway and the mines are 8 km to the south near the town of Bjørnevatn, Norway. As a result of the acquisition, Tacora has the option to restart the Sydvaranger Mine which is shovel ready and fully permitted in a tier 1 jurisdiction. Sydvaranger is currently under a care and maintenance program.